Top 3 Cybersecurity Challenges Facing the Finance Sector in 2017

The finance sector is no stranger to adversity. Financial service organizations have been beleaguered by recessions, lackluster stock prices, unprecedented competition, tough new regulations, and constant cyberattacks. In fact, these recent challenges have changed the entire industry. Battle-tested, the organizations that survived this chaotic time are poised to flex their leaner, more mobile and agile capabilities in 2017. By many indications, next year appears to be one where we start to see a stronger, grittier sector - a stark contrast to the banking systems of the past.

When I started working in this sector about a decade ago, IT security meant an access control policy, a firewall and a robust anti-virus platform. Today, large banks are often pioneering proprietary, leading-edge cybersecurity software. The close collaboration between banking IT security and top cybersecurity companies is unlike any other sector.

Large banks are often pioneering proprietary, leading-edge cybersecurity software

Banks are more prepared to handle cybersecurity threats these days, but challenges still loom. Take a look at the top three challenges that financial organizations will face in the new year:

1: Emerging technology challenges

Recently, the world suffered from distributed denial of service (DDoS) attacks spawned from a botnet made up of so-called smart devices within the Internet of Things (IoT). Shortly after one attack, the perpetrator publicly released the code used in the DDoS assault on the KrebsOnSecurity website, making it available for anyone to use.

The code, called Mirai, is designed to search for and attack internet-connected devices that are protected by default passwords and usernames. Because Mirai is basically now an open source hacking tool that can tap into millions of unsecured IoT devices and sensors, organizations in all sectors are going to be vulnerable to DDoS assaults.

A challenge in the finance sector that makes this style of attack potentially crippling is that banks need to provide customers access to their money. A downed website because of a DDoS attack could anger a lot of customers, something no bank ever wants to face.

2: Nefarious insider challenges

Attacks from insider threats will also pose a larger problem in 2017. In particular, attacks stemming from the dark web, which has been reaching out to insiders to buy their login credentials or has attempted to get insiders to sell intellectual property, will be a big problem. An insider attack may not just be a disgruntled employee; the threat could be someone who is tempted by outside influences and bribed to share inside information.

Retail banks, or those that still operate with a large physical presence, use tellers. According to a recent study by scheduling-software company FMSI: "many banks struggle with finding and keeping good part-time [tellers] employees, leading to undesirable results."

Tellers are often not happy with their jobs, are underpaid, deal with the threat of armed robbery and stand all day dealing with constant, complex customer issues. Their job also requires a lot of skill and training and is now more “digital” than ever before. Someone working a job like that is a perfect target for organizations looking for insider information for an attack. Offering several thousand dollars for a password or other security information can be quite compelling.

Financial organizations will need to build and bolster insider threat detection programs in 2017 or face a new wave of successful attacks.

3: Regulation challenges

New regulations are something most banks will have to face in 2017. For example, in the U.S., a labor department financial-advice rule that goes into effect in April of 2017 will change the way customers interact with Wealth Management Advisors. This regulation is an attempt to provide greater fee transparency between financial planners and those saving for retirement. To the financial companies, this regulation will change the way they do business from an organization-back-end. This regulation also introduces new risks to companies that do not properly communicate to existing and future customers.

As a result, U.S. financial institutions with Wealth Management Advisors will have to implement new IT infrastructures, which could result in new information silos.

Turning to the EU, the recent adoption of a cybersecurity regulation called the General Data Protection Regulation (GDPR) addressing the export of personal data outside the EU will take effect in early 2018. That will have a big effect on how international banks operate:

Financial institutions and service providers to the financial industry process a vast amount of personal data on a daily basis. Much of the data processed is confidential and sensitive. This means there are increased risks and a likelihood of a focus on this sector by supervisory authorities, which will have new rights to audit and to impose administrative fines. Indeed, the GDPR allows for administrative fines which can amount to a maximum of 20 million euros or 4 percent of the global annual turnover of a company. – Financier Worldwide

Facing a fine of 20 million euros or four percent of revenue is a big risk banks will have to stay clear of in 2017.

Solutions for 2017

All three challenges facing the finance sector share a common denominator: transparency. These challenges require that Security Operation Centers, IT security personnel and IT leaders have access to real-time data transparency concerning the status of their networks and level of insider threats.

All three challenges facing the finance sector share a common denominator: transparency

Continuous active scanning, passive detection, log analysis, vulnerability management and compliance testing across the complete organization are critical to crossing the three big hurdles facing this industry in 2017.

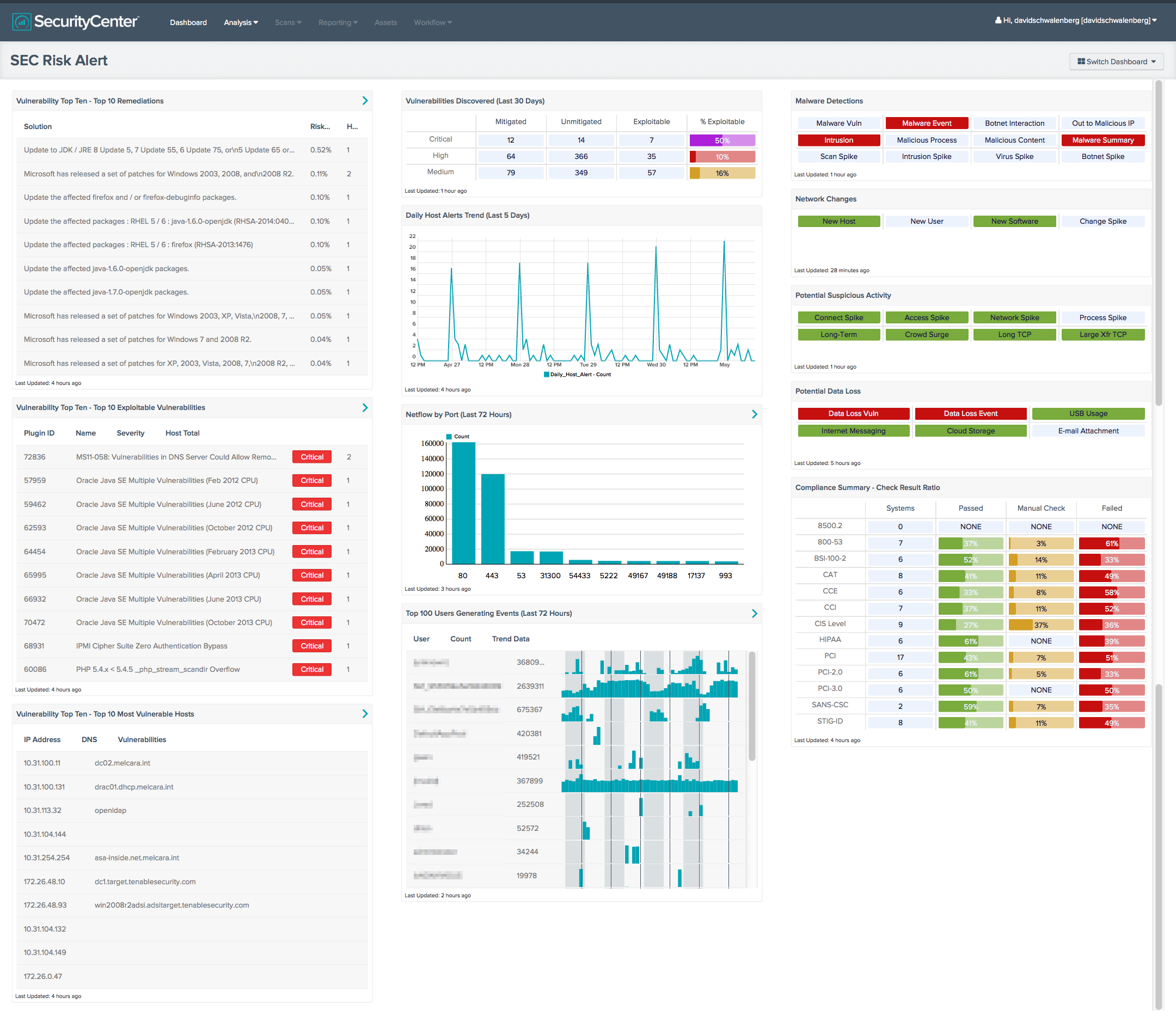

Tenable products can assist organizations in meeting these challenges. SecurityCenter Continuous View® (SecurityCenter CV™) provides a real-time, holistic view of all IT assets, network activity and device events that helps you locate exploits and address vulnerabilities quickly. The SecurityCenter highly customizable dashboards also help support compliance testing across an organization.

These customizable dashboards can be fine-tuned to deliver targeted analyses of cybersecurity risks. For example:

- The Monetary Authority of Singapore (MAS) published new Technology Risk Management (TRM) Guidelines in June 2013. As a result, Tenable developed the MAS TRM Guidelines dashboard, which provides a high-level overview of information relevant to specific sections in the TRM Guidelines.

- The GLBA Malicious Code Prevention dashboard tracks compliance with the Gramm-Leach-Biley Act (GLBA) that protects the private information of individuals.

- The SEC Risk Alert dashboard presents data to assist in the evaluation of an organization’s cybersecurity preparedness, as defined by the U.S. Securities and Exchange Commission.

These are just a few of the many detailed SecurityCenter dashboards that can help combat the major challenges facing security and IT professionals in the financial services.

Armed with the right tools, the future for finance in 2017 is brighter than it has been in many years.

The finance sector may be no stranger to adversity, but with Tenable solutions, financial organizations can detect emerging threats and perform the real-time discovery of resources necessary to protect their networks and surpass compliance standards. Armed with the right tools, the future for finance in 2017 is brighter than it has been in many years.

- Financial Services